If you’re an avid traveler looking to elevate your travel experience, the Platinum American Express Card might be the perfect addition to your wallet. Despite its hefty $799 annual fee, this card offers a range of benefits and perks that can justify the cost for those who make the most of them. In this post, we’ll break down the key reasons why the Platinum Amex card might be worth every penny, but only if done well.

Generous Welcome Bonus

Timing can make all the difference when applying for this card. I made the mistake of not waiting a bit longer for a more substantial welcome bonus, but I had a big spend coming up, so I had no other choice. Currently, they’re offering a tempting 100,000 Membership Reward (MR) points. You get 70,000 points after spending a hefty $10,000 CAD in the first three months of card ownership, and you’ll get another another 30,000 points when making any purchase in the 14th to 17th month of card ownership. It’s a substantial spending requirement, but with some smart planning, it’s achievable. It also means you need pay the annual fee twice to get the full welcome bonus.

$200 Annual Travel Credit

In my first year with the Platinum Amex, I used the $200 annual travel credit to cover a hotel stay in Paris. The following year, I paired it with already discounted business class flights (more on that later) with WestJet booked through the Amex Travel portal. The key here is to use this credit to amplify experiences you’re already planning, making it a valuable addition to your travel budget.

$200 Annual Dining Credit

Introduced recently in tandem with a $100 annual fee hike: a $200 annual dining credit, based on the calendar year, is a great addition. If you have the card for one year that spans two calendar years, it’s essentially $400. While the list of eligible restaurants tends to be on the upscale side, it’s a perfect way to turn a special dining occasion into an affordable treat.

Discounts on Premium Flights

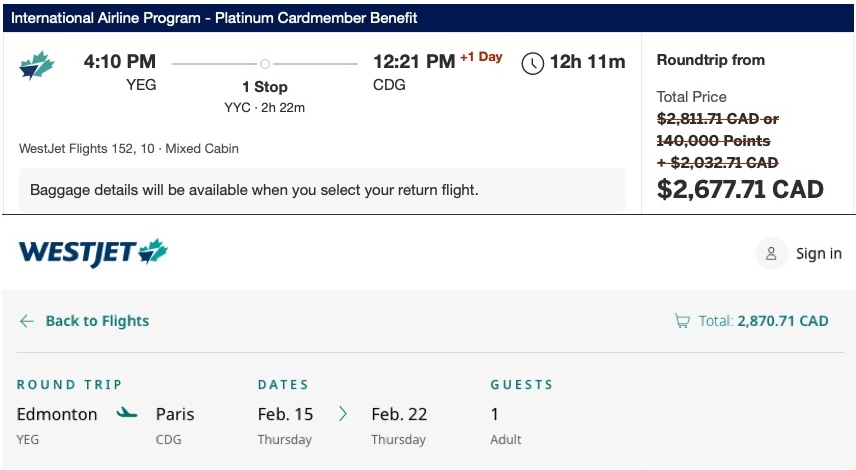

The International Airline Program is a little-known secret that comes with the Platinum Amex card. It offers discounts of up to 15% on premium economy and business class flights with select airlines. This feature has been a game-changer for my travel plans, especially when booking with airlines like KLM and WestJet. The savings, combined with the annual travel credit, have more than justified the card’s annual fee. A quick comparison between the cheapest available return flight between Edmonton and Paris in February of 2024 shows that you get an almost $200 discount when booking with Amex using the International Airline Program. Sure, business class travel is more expensive than economy, but it’s a welcome bonus when you already fly business class anyway.

Lounge Access

Among all the perks, lounge access has become my absolute favourite. In Canada, most airports have lounges accessible through Amex Platinum in the domestic terminal (with Montréal being the exemption mostly). Internationally, I’ve enjoyed the Centurion Lounges in Buenos Aires and Mexico City. The savings on food and drinks at airports have been substantial, not to mention the comfort and convenience these lounges provide.

If you fly in premium cabins often, you know that lounge access is often available using your boarding pass, but I’ve had several occasions where the airline I flew with (looking at you, WestJet in Dublin) didn’t have a contract with the lounge. Lounge access through the card in that case, or even when flying in economy, is a huge asset in that case.

NEXUS Fee Credit

If you’re a frequent traveler between Canada and the U.S., the $100 CAD NEXUS fee credit, which is provided once every four years, can pay for the Nexus fees of almost two people. This is a fantastic program that simplifies border crossings.

Personalized Offers

Personalized offers can be unpredictable. They don’t show up immediately after getting the card and they’re often not suitable for your personal situation, so don’t bank on them. However, when they do appear, they can be quite rewarding. I’ve received credits for airline purchases and even enjoyed a year of free Disney+ through the card.

In conclusion, the platinum card is definitely aimed at a specific niche of users that enjoy premium travel. If you generally tend to fly in business class anyway, this card will soften the bill on those tickets and it’ll make the card pay for itself. However, if the card makes you spending more money than you would otherwise, you may look into another card. For me however, doing an annual back-of-the-napkin calculation, the card definitely pays for itself. You’ll just have to do the math for yourself.

If you’re a resident in Canada and you’ve gotten interested in the card after reading this, I would appreciate you using my referral link here.